Millennial Money Mistakes You Can Still Fix Today

Millennials have been handed a mixed financial bag. Student loans, housing bubbles, gig work, fun times, right? Add a dash of financial misinformation and a sprinkle of lifestyle inflation, and you’ve got a recipe for some classic money mistakes. But here’s the good part: it’s not too late to fix them.

Living Without an Emergency Buffer

Many millennials are one flat tire away from disaster. That might sound dramatic, but it’s often true. Living paycheck to paycheck leaves zero room for surprise expenses. Start small. A basic emergency stash of even $500 – 1000 is better than nothing. Automate that savings if you can. Treat it like a non-negotiable bill, not an optional add-on.

Many millennials are one flat tire away from disaster. That might sound dramatic, but it’s often true. Living paycheck to paycheck leaves zero room for surprise expenses. Start small. A basic emergency stash of even $500 – 1000 is better than nothing. Automate that savings if you can. Treat it like a non-negotiable bill, not an optional add-on.

Treating Credit Like Bonus Cash

There was a time when swiping felt like free money. No immediate consequences, just instant gratification. But that convenience comes with interest, and interest has a long memory. Credit cards aren’t evil, but they do demand discipline. If your balance has ballooned, make a plan. Start with the smallest card and pay it off, then move on to the next. This strategy builds momentum and confidence. Don’t wait until you’re dodging debt collectors or feeling trapped. Getting ahead of it now saves you thousands later.

Trying to Match Everyone’s Lifestyle

Social media is a sneaky thief. It steals your peace and empties your wallet, often at the same time. Comparing your life to someone else’s highlight reel is a fast track to spending beyond your limits. Buying things to “keep up” might impress people who aren’t even paying attention. And even if they are, they won’t be helping you pay off that designer couch. Instead, build habits around your real goals, not someone else’s aesthetic. That kind of discipline lasts longer than any shopping spree.

Waiting Too Long to Invest

Some millennials think investing is for later, like way later, after kids, after mortgages, after some mythical moment when life “settles down.” But the truth? The earlier you start, he easier it gets. Compound interest is like planting a tree: the sooner you do it, the more shade you’ll have. You don’t need millions to begin. Even small, consistent contributions can grow over time. Apps, employer options, or direct stock purchases, pick one and move. Time is still on your side, but it won’t be forever.

Relying on Hope Instead of a Plan

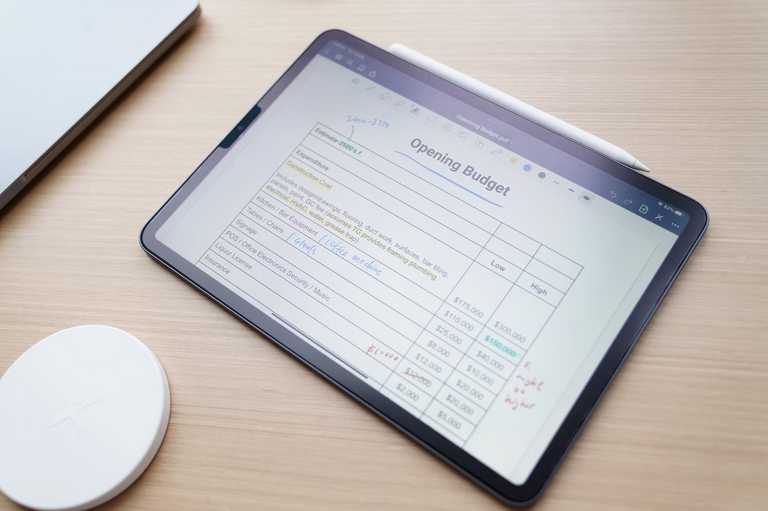

Vague promises don’t pay off debt. Start with a plan that doesn’t feel like punishment. Use cash envelopes, simple spreadsheets, or even good old pen and paper. Set short-term goals so you get quick wins. A budget doesn’t need to be fancy, it just needs to work. And once it works, stick with it. No one gets everything right on the first try. But fixing old habits isn’t about shame, it’s about making better choices today. Financial progress isn’t flashy. It’s small wins, smart pivots, and a little less wishful thinking. The good news? You’ve still got time. Start now, your future self will thank you with compound interest.…

Read More

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal. When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on.

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on. We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…

One of the biggest risks facing

One of the biggest risks facing  Bitcoin is currently facing a major problem with

Bitcoin is currently facing a major problem with  Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.

Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.